Writing Off an Invoice

You can use the Cash Receipts form to write off a customer invoice.

To write off an invoice on the cash receipts form:

| 1. | Access the Cash Receipts form (found in the Back Office menu under Accounts Receivable|Action). |

| 2. | Use the form to edit a new or existing cash receipts batch: |

| • | To open an existing batch, click the Batch ID in the Cash Receipts panel. |

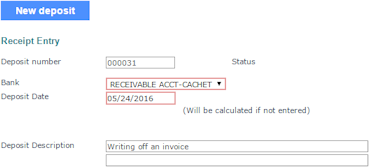

| • | To start a new cash receipts batch, click New deposit in the Receipt Entry panel. |

| 3. | The Deposit number populates automatically. You can edit it. |

| 4. | Select the Bank. |

| 5. | You can enter the Deposit Date, or allow the system to populate it automatically with the current date. |

| 6. | Enter a Deposit Description, if desired. For example, you can enter the reason for the write-off transaction or the actual date if it is different from the posting date. There are two lines that you can use. |

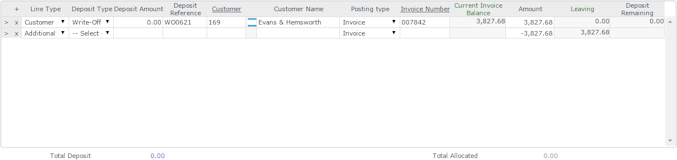

| 7. | Enter the initial Deposit Detail information as shown: |

|

Column |

Description |

||||||

|---|---|---|---|---|---|---|---|

|

Line Type |

Select Customer. |

||||||

|

Deposit Type |

Select Write-Off. |

||||||

|

Deposit Amount |

Enter 0.00. |

||||||

|

Deposit Reference |

Enter the unique reference ID, which can include alphanumeric characters but not spaces. |

||||||

|

Customer ID |

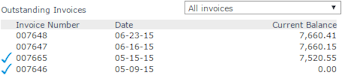

Enter the customer ID here. The customer's Outstanding Invoices display. |

||||||

|

Customer Name |

Defaults to the name associated with the Customer ID. You can change this if the name on the check is different. |

||||||

|

Posting Type |

Select the posting type for Invoices. |

||||||

|

Invoice Number |

Click an invoice number in the Outstanding Invoices list to add its information to the line. Otherwise, continue entering information.

|

| 8. | Enter a second line in the Deposit Detail panel: |

| • | Set Line Type to Additional. |

| • | Select the Posting type for write-offs. |

| • | Enter the negative cash value in the Amount field that "cancels" the total invoice amount. |

| 9. | Go back to the first line and enter the positive cash value in the Amount field to write off the invoice. |

| 10. | Make sure the Deposit Remaining displays as 0.00. |

| 11. | If you are done entering details for this posting, click Post. |

Otherwise, click Clear – the system saves your progress as an open batch at the top of the form.