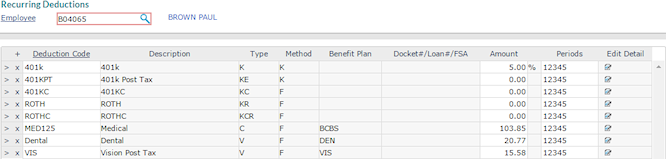

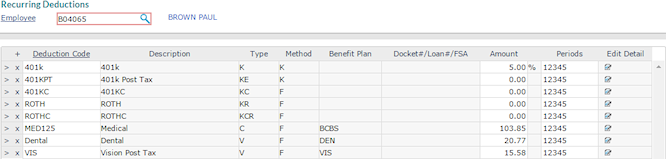

Working with Recurring Deductions

The Recurring Deductions form lists all payroll deductions, with the exception of payroll taxes. Use this form to enter voluntary deductions for the selected employee. For example:

There is no limit to the number of defined deduction codes you can enter for an employee. You cannot enter the same deduction code more than once for the same employee, however, with the exception of loans and garnishments.

Note the following:

|

•

|

On the Recurring Deductions form, you can only edit voluntary deductions that are not associated with a plan. |

|

•

|

If you enter or select a voluntary deduction with an assigned rebate bill code, an error message displays, "A Third Party Payee can only be applied to a Voluntary type deduction code with no Rebate Bill Code assigned. Check the deduction code settings or apply the Third Party Payee to an applicable code." Click OK to continue. |

|

•

|

If you enter or select a restricted deduction code (that is, a code not submitted on the Control tab in the Client Details form), a warning displays and you cannot save the record, "Warning - <deduction code> is not a deduction code defined on the <client> Client Detail Control tab." Click OK to continue. |

Note: Service providers can enable the ALLPAYCODESINT custom feature code on the System Parameters form to override the restriction listed above, so the system imports any deduction codes, including the allowed deduction codes that are defined in the Control tab on the Client Details form. (See Using Custom Feature Codes.)

|

•

|

When the first payroll for a pay period is processed with a zero ($0.00) amount without enough funds to cover a voluntary recurring deduction, the system takes the deduction on the next payroll for the same pay period, if there are funds available to cover it. |

To enter voluntary deductions:

|

1.

|

Enter the Employee by either entering the name, Social Security Number, or ID to display a pop-up list of matching employee records. You can also click the field label or press Ctrl+Enter with your cursor in this field to open the search window. The system displays the current deductions. |

|

2.

|

You can enter voluntary deductions. For each deduction to take: |

|

•

|

Enter the Deduction Code. The corresponding Description, Type, Method, Benefit Plan, and Docket#/Loan#/FSA display as appropriate. If you enter a code that is not defined for the client, the system displays a warning message to confirm that you want to use that code. |

|

•

|

Enter the deduction Amount. This is either a percentage or fixed amount, depending on the calculation method defined for the deduction code. |

|

•

|

Enter the deduction Periods that determine when this deduction is taken from the employee's net earnings after payroll taxes. |

Deduction Type Definitions

Deduction Methods

Maintaining Global Deduction Codes

Pay Codes in Client Details Setting Client Control Parameters