Importing Multiple Unbundled Billing Rules

Use the Unbundled Billing Rules Import form to import multiple unbundled billing rules for clients associated with a specific bill code. For example:

Note: Client Access Group security is enabled on this form.

To access the form, click Back Office menu. Under Operations|Action, click Unbundled Billing Rules Import.

Note: This form is only available for service providers.

To import unbundled billing rules:

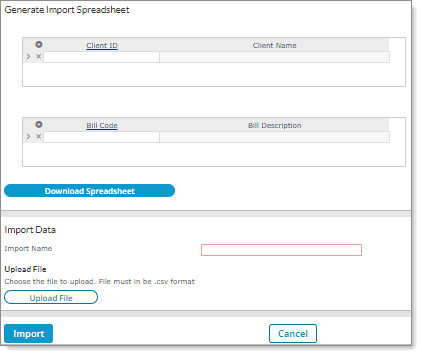

| 1. | In the Generate Import Spreadsheet section, create an import spreadsheet by entering or selecting the Client IDs and Bill Codes. (You can select multiple clients from the Select Clients list at once.) The Client Name and Bill Description display next to each client. (If left blank, the system selects all clients and bill codes.) |

| 2. | Select Download Spreadsheet. The system creates a spreadsheet that displays in a separate window, which is suitable for editing. |

| 3. | In the Import Data section, enter an Import Name. (This is a required field; you cannot import a file without this information.) |

| 4. | Select Upload File. Click Add Files and select the file to upload, then click Start Upload. (This file must be in .csv format.) |

| 5. | Click Close. A separate Downloads window displays the name of the .csv file that the system created. (Click Open file to view the downloaded file.) |

Note: The first row in the downloaded file displays information about the first rule and the multi-value fields, which are separated by a pipe delimiter (|).

| 6. | Click Import. Processing steps describe the information saved and include a date and time stamp. You can view this as a report or download in PDF or XLS format by clicking Report. |

| 7. | Click Close. |

| 8. | Click Transaction Report to display a link to a report that contains the unbundled billing rules transactions. |

Note: The Transaction Report displays "Skipped" for any column in a row that has valid data but was not imported because a required row contained invalid data. (All invalid data displays in the Transaction Report.)

| 9. | Click Error Report to display a link to a .csv file that details the errors that occurred during the import. (The system does not import any rows listed in the error file and only imports rows where all data in the row is valid.) |

Note: The Error Report link only displays if errors occurred during the import, which confirms that the system is unable to perform the import.

Note the following:

| • | You can only select active clients in the Client ID field. |

| • | If a Per Active Employee Per Month (PAEPM) rule is already active for a client, you cannot import another active PAEPM rule for that client. (A warning displays if you try to import another PAEPM rule using the same rule dates, which would make them active at the same time.) |

| • | If you enter an inactive client or a client that you are not allowed to access the following error message displays, "Invalid Client ID." |

Adding New Rules to an Import

Using the import process, you can define new rules that the system adds to the Billing Rules (Unbundled) form. To do this, you must enter the rule as NEW. For example:

| • | Row 1 - NEW: Contains all the rule details and all the multi-value details associated using a pipe delimiter |

| • | Row 2 - NEW: Contains all the rule details and all the multi-value details associated using a pipe delimiter |

Note the following:

| • | Rules display one row after another using sequential numbers. Therefore, do not use a numeric value after each row. |

| • | If there are any errors, they display in the error report. (You can view errors by clicking Error Report.) |

Define the following information for the import:

| Field |

Details |

Description | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client ID |

|

Unique identifier for the client. | ||||||||||||||||||||||||||||||

| Rule |

This field is pre-defined. Note: If you create a NEW rule, the next sequential value is selected. |

Existing Billing Rule ID, or New Rule to create a new unbundled billing rule. The system automatically assigns an ID. | ||||||||||||||||||||||||||||||

|

Rule Description |

This is a free-form field where you can enter the description. |

Describes the rule. (This description cannot exceed 40 characters.) |

||||||||||||||||||||||||||||||

|

Rate |

Allows numeric value up to 4 decimal places. |

Billing Rate. The system uses this in conjunction with the Based On value. |

||||||||||||||||||||||||||||||

|

Based On |

Codes used as basis for calculating unbundled billing rules. |

Based On value, which represents the logic to use when calculating the rate. |

||||||||||||||||||||||||||||||

|

Rule Start Date |

Date format MM/DD/YYYY. |

Rule Start Date when this rule begins. |

||||||||||||||||||||||||||||||

|

Rule End Date |

Date format MM/DD/YYYY. |

Rule End Date when this rule ends. |

||||||||||||||||||||||||||||||

|

Voucher Types |

Allowed types:

Note:

|

Voucher Types to which a billing rule applies. |

||||||||||||||||||||||||||||||

|

Employee ID |

Can use alpha-numerical characters. For example, P12345. |

If the billing rule applies to a single employee, use the Employee ID. If the billing rule applies to all employees who do not have another billing rule assigned to them, leave this field blank. |

||||||||||||||||||||||||||||||

|

Batch Type |

Allowed types:

Note:

|

Batch Type to which this billing rule applies. |

||||||||||||||||||||||||||||||

|

Employee Type |

Can vary by client (F, P, and so on). Setup: System|Change|Employee Types. Note: Obsolete types are not allowed. |

Employee Type to which this billing rule applies, if any. For example, FT is a full time employee. |

||||||||||||||||||||||||||||||

|

Pay Group |

Can vary by client (W, BW, and so on). Setup: Payroll|Change|Pay Groups. |

Pay Group to which this billing rule applies, if any. For example, W is a weekly pay group. |

||||||||||||||||||||||||||||||

|

Deduction Period |

Allowed values: 1, 2, 3, 4, or 5. |

Deduction Period number (1 through 5) to which this billing rule applies, if any. If employees are paid during this period, the system assesses a fee. If you use a Deduction Period, you must also use a Pay Group unless Based On is set to Flat Amount / Benefit Plan Class. |

||||||||||||||||||||||||||||||

|

Position |

Varies by client. Setup: Client|Change|Positions. |

Position to restrict the billing rule to one position. For example, SALES is a position type. |

||||||||||||||||||||||||||||||

|

Pay Period |

Allowed pay periods:

|

Pay Period to which this rule applies. If it applies to all periods, do not use a pay period. |

||||||||||||||||||||||||||||||

|

Home Location |

Varies by client. Setup: Client|Change|Worksite Locations. |

Home Location to limit the application of this unbundled billing rule to that location. If the rule applies to all locations by default, use DEFAULT-ALL. Using DEFAULT-ALL for a billing rule allows locations to have “by exception” logic. For example, you could have a rule where all locations are charged $100 except for the CORP location, which is charged $40. In that case, you would create two billing rules: one with the DEFAULT-ALL location code and one with the CORP location code. |

||||||||||||||||||||||||||||||

|

Special Rate |

Allows numeric value up to 4 decimal places. |

Special Rate in effect for a specified period. The system uses this value instead of the standard rate. |

||||||||||||||||||||||||||||||

|

Special Rate Start |

Date format MM/DD/YYYY. |

Special Rate Start date when the special rate goes into effect. |

||||||||||||||||||||||||||||||

|

Special Rate End |

Date format MM/DD/YYYY. |

Special Rate End date when the special rate ends. |

||||||||||||||||||||||||||||||

|

Billing Code |

Use if the special rate only applies during a specific period. Setup: System|Change|Billing Codes. |

Billing Code the system uses. Typically, this is 006, but you can assign another code to use instead of this standard administration fee. |

||||||||||||||||||||||||||||||

|

Benefit Plan |

Setup: Benefit Plan Maintenance|Group Benefit Plans (Global)|Group Benefit Plans |

Benefit Plan to use when calculating an administrative fee. This field only impacts calculations when the rule’s Based On field is set to Percent of Listed Benefit or Percent of Listed Benefit Net Billed to Client. |

||||||||||||||||||||||||||||||

|

Pay Class Equal To/Pay Class Not Equal To |

Allowed pay classes:

|

If the billing rule applies to only a few pay classes, list them in the Pay Class Equal To table. If there are only a few exceptions, use the Pay Class Not Equal To table instead. If the billing rule covers all pay classes, leave both tables empty. For example, set Pay Class Not Equal ToExpense Reimbursement when you do not want to calculate Admin Fee as a percentage of wages on non-taxable wages. |

||||||||||||||||||||||||||||||

|

Pay Code Equal To/Pay Code Not Equal To |

Setup: System|Change|Pay Codes |

If the billing rule applies to only a few pay codes, list them in the Pay Code Equal To table. If there are a few pay code exceptions, use the Pay Code Not Equal To table to list the pay codes not covered by this billing rule. If the billing rule covers all pay codes, leave both tables empty. |

||||||||||||||||||||||||||||||

|

Use Timesheet Location Or State |

Allowed values:

|

Only displays for rules based on Percent of Wages or Percent of WorkerComp Billed. If enabled, the billing rule targets the location or state billed on the time sheet. |

||||||||||||||||||||||||||||||

|

Benefit Plan Class |

Allowed benefit plan classes:

|

This field is only active when Based On is set to Flat Amount / Benefit Plan Class. Use one of the classifications used for group benefit plans or use Retirement. The system charges the amount once if an employee has any plans in that class (unless the group benefit plan is set to suppress flat billing by plan type). If there is a benefit adjustment in addition to the regular plan, the billing rule is applied only once. If the pay voucher has only benefit adjustments, then the billing rule applies once. |

||||||||||||||||||||||||||||||

|

Benefit Plan Type Equal To/Benefit Plan Type Not Equal To |

Allowed benefit plan classes:

|

Benefit Plan Type Equal To for which you bill an administrative fee surcharge, or use each Benefit Plan Type Not Equal To for which you do not bill an administrative fee surcharge. |

||||||||||||||||||||||||||||||

| EE Tax Codes |

Employee-specific tax deduction codes. Setup: System|Change|Tax Deductions. |

Employee tax deduction codes to associate with this billing rule. | ||||||||||||||||||||||||||||||

|

EE Tax Per Employee |

Allowed values:

|

Indicate whether to charge the code Per Employee. If not, then the system assesses the charge once per payroll batch. |

||||||||||||||||||||||||||||||

|

EE Tax Bill Rate |

Allows numeric value up to 4 decimal places. |

Bill Rate to charge on the code. |

||||||||||||||||||||||||||||||

|

EE Tax F/P |

Allowed values:

|

Indicate whether the amount is a Flat Rate or a Percent. |

||||||||||||||||||||||||||||||

|

ER Tax Code |

Employer-specific tax deduction codes. Setup: System|Change|Tax Deductions. |

Employer tax deduction codes to associate with this billing rule. |

||||||||||||||||||||||||||||||

|

ER Tax Per Employee |

Allowed values:

|

Indicate whether to charge the code Per Employee. If not, then the system assesses the charge once per payroll batch. |

||||||||||||||||||||||||||||||

|

ER Tax Bill Rate |

Allows numeric value up to 4 decimal places. |

Bill Rate to charge on the code. |

||||||||||||||||||||||||||||||

|

ER Tax F/P |

Allowed values:

|

Indicate whether the amount is a Flat Rate or a Percent. |

||||||||||||||||||||||||||||||

|

The following "additional details" fields reside on the Unbundled Billing Additional Details form, which you can access by selecting Additional Conditions on the Actions menu in the Billing Rules (Unbundled) form. |

||||||||||||||||||||||||||||||||

|

Use If Any ACH |

Allowed values:

|

Indicate whether to apply this billing rule on a voucher with ACH. |

||||||||||||||||||||||||||||||

|

Use Per ACH Line |

Allowed values:

|

Indicate whether to charge a fee for each ACH line. |

||||||||||||||||||||||||||||||

|

Use If Electronic Stub |

Allowed values:

|

Indicate whether to apply only to electronic pay stubs. |

||||||||||||||||||||||||||||||

|

Use If Any Garnish |

Allowed values:

|

Indicate whether to apply this rule if there are any garnishments. |

||||||||||||||||||||||||||||||

|

Use Per Garn Item |

Allowed values:

|

Indicate whether to charge a fee for each garnishment. |

||||||||||||||||||||||||||||||

|

Use If Any Check |

Allowed values:

|

Indicate whether to apply the rule for any pay voucher. |

||||||||||||||||||||||||||||||

|

Exclude From Manual Check |

Allowed values:

|

Indicate whether to suppress the billing (delivery fee) for a manual check that occurs when a billing rule is processing live checks. |

||||||||||||||||||||||||||||||

|

Rule Minimum |

Must be a numeric value. |

Indicate the least amount this rule should bill. |

||||||||||||||||||||||||||||||

|

Rule Maximum |

Must be a numeric value. |

Indicate the dollar limit for this rule. |

||||||||||||||||||||||||||||||

|

Exclude from FPEIMIN |

Allowed values:

|

Indicate whether to exclude this rule from the Flat Amount/Per Employee Invoice Minimum billing rule. |

||||||||||||||||||||||||||||||

|

States Equal To |

Must be a valid state. |

If you enable Use If Any Check field, enter a list of State(s) Equal To where this unbundled billing rule applies. |

||||||||||||||||||||||||||||||

|

FSA Plan Type Equal To |

|

Indicate each FSA Plan Type Equal To that causes the system to apply this rule. The system applies the rule once for any of the plans. To associate a fee with each plan, create a separate rule. |

||||||||||||||||||||||||||||||

|

FSA Plan Type Not Equal To |

|

Indicate each FSA Plan Type Not Equal To that should not be present to cause the system to apply this rule. |

||||||||||||||||||||||||||||||

|

Retirement Plan Equal To |

|

Indicate each Retirement Plans Equal To that if found on the voucher applies this rule. |

||||||||||||||||||||||||||||||

|

Retirement Plan Not Equal To |

|

Indicate the Retirement Plans Not Equal To that if not used on the voucher applies this rule. |

||||||||||||||||||||||||||||||

|

Obsolete |

Allowed values:

|

Indicate whether the billing rule is Obsolete. (The system reads a blank value as "No.") |

||||||||||||||||||||||||||||||

|

Obsolete Date |

Date format MM/DD/YYYY. |

Obsolete Date when this billing rule was obsoleted. (Must be in date format.) |

||||||||||||||||||||||||||||||

Updating Existing Rules

When you update an existing rule in the Unbundled Billing Rules Import form, the import must identify the rule number being updated and include details that for the updated rule. For example, Rule 1 defines Pay Group A. If the updated rule then lists Rule 1 as Pay Group B, after the import finishes Rule 1 now uses Pay Group B.

After you import the updated rule, you can view the Transaction Report to determine which values were imported. (You can view errors by clicking Error Report.)

Note the following:

| • | Anything included in the file updates the current rule. |

| • | Running the import updates the rule or adds to the rule depending on the fields completed in the file. |

| • | Using a blank field removes any existing data. (If you only want to change one field, then you should download the rule, make the update to that field, and then re-import.) |