Defining Methods for Billing Clients

Use the Billing Templates form to define methods for billing clients.

Establishing Parameters Required to Bill Clients

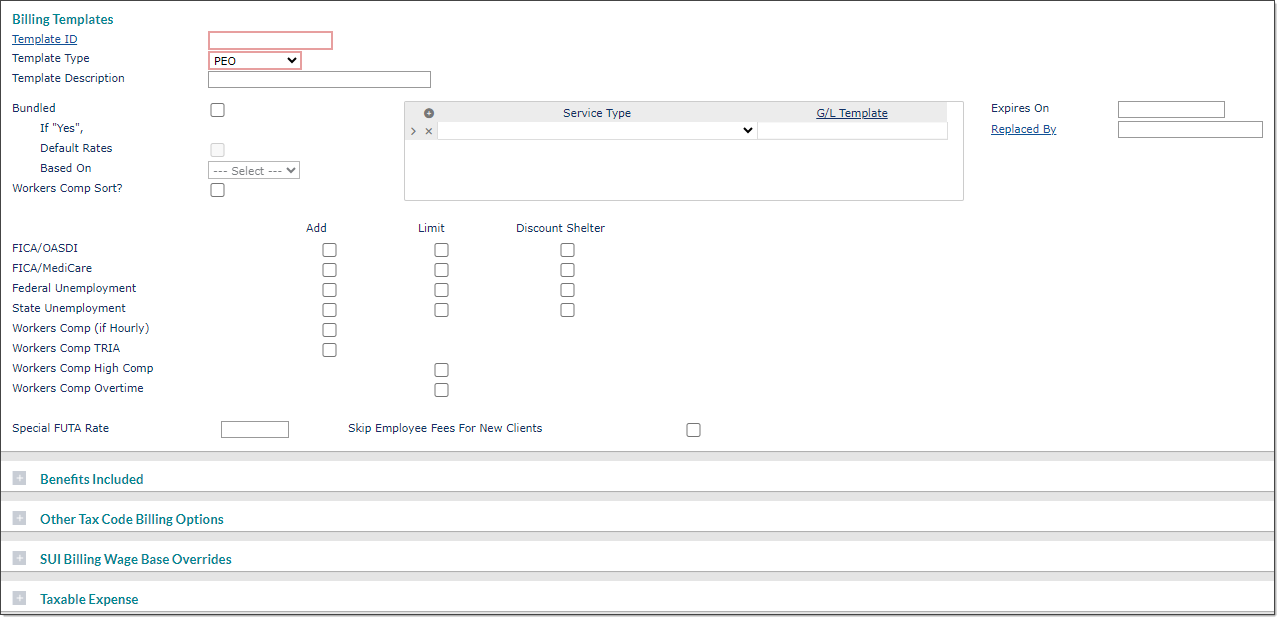

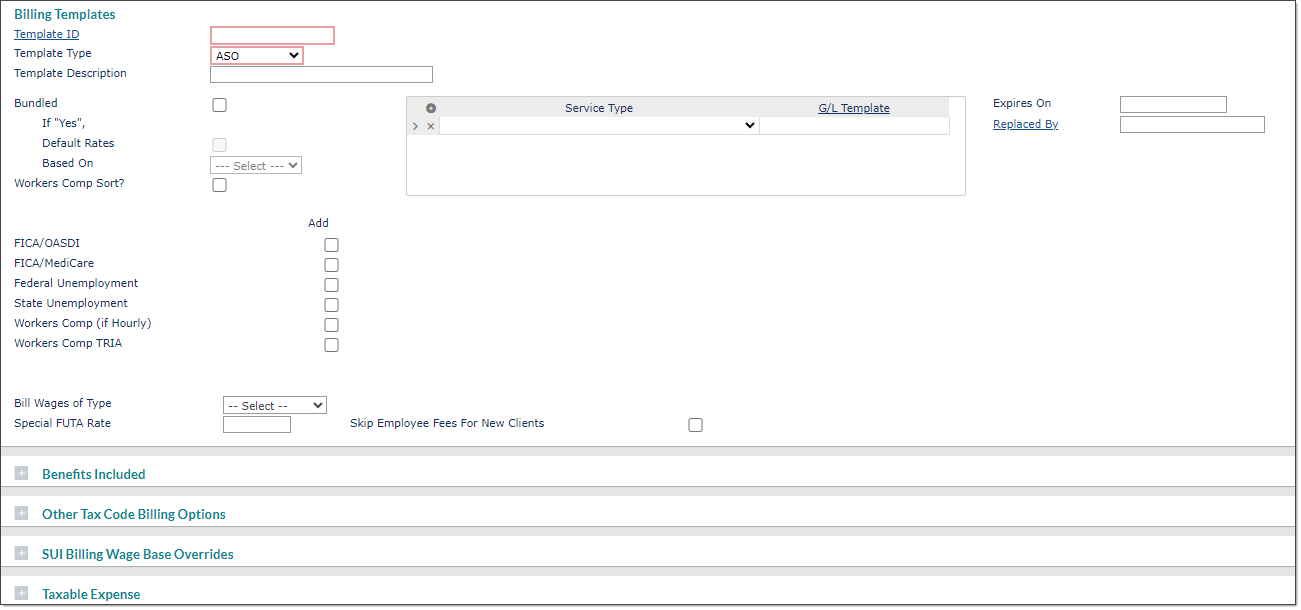

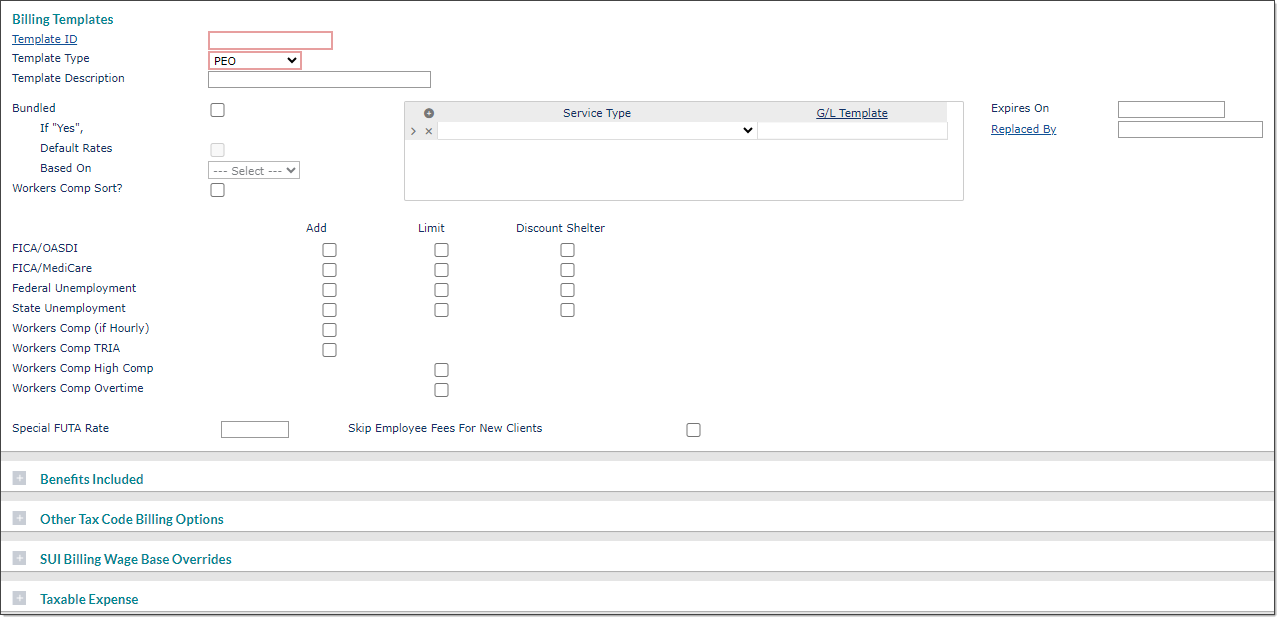

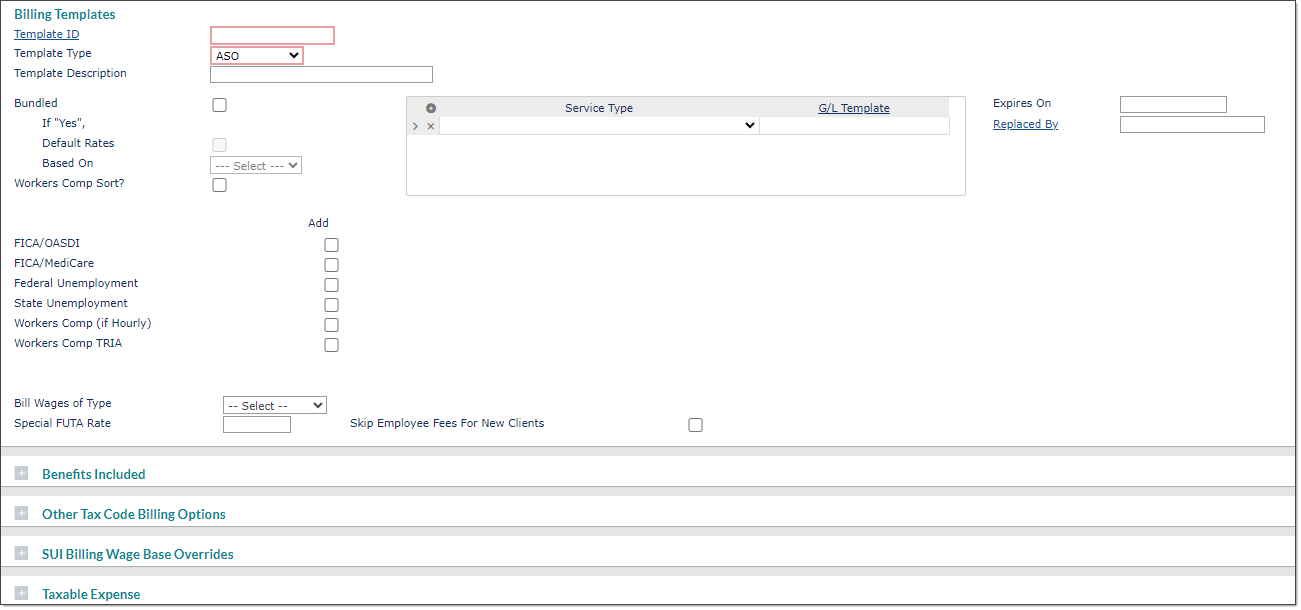

The Billing Templates panel establishes the parameters required to bill a client for services.

Example of the Billing Templates form (PEO type)

Example of the Billing Templates form (ASO type)

To configure billing templates:

|

1.

|

Enter the Template ID used to access this billing template. |

|

2.

|

From the Template Type list, select whether this template applies to PEOs or ASOs. Selecting one of these options does the following: |

|

•

|

PEO: Allows users to enable check boxes in the Limit and Discount Shelter columns as default items. |

|

•

|

ASO: Automatically defaults to honoring Limit and Discount Shelter column items. |

|

3.

|

Enter a Template Description. |

|

4.

|

Select Bundled if this is a bundled billing template. The client is billed at a fixed rate and the Admin fee is a squeezed computation. |

Note: You cannot select the Default Rates check box unless you also select the Bundled check box.

|

5.

|

Select Default Rates to use the standard default rate. |

|

6.

|

Select the Based On method, which determines whether to base the Admin fee on Units or Wages. If you select Units, you must also complete the Bundled Unit Based Maintenance panel. |

|

7.

|

Select Workers' Comp Sort if the invoice should sort and break on Workers' Compensation codes. The system applies this sort after other sorts for the stack invoice only. |

Other sorts are set at the client level (by department, division, location, and so on). The stack invoice formats the invoice differently, presenting hours, wages, and extensions—usually for bundled billing.

|

8.

|

Select the service types and matching G/L templates: |

|

•

|

Enter each Service Type for which this billing template can be used. |

|

•

|

Enter the G/L Template that is appropriate for this billing template and Service Type. |

|

9.

|

Enter the billing template expiration date in the Expires On field, if any. After this date, PrismHR will not allow your organization to process payrolls using this template until it is updated. |

|

10.

|

Select the Replaced By template, which is the template that replaces this one after the expiration date in the Expired On field. |

|

11.

|

Select the check boxes as appropriate. (Fewer check boxes are available for ASO templates than for PEO templates.) |

|

•

|

Select Add to indicate that each bill item is an add-on to the compensation rates for unbundled amounts. |

For Workers' Comp (if Hourly), this determines whether to add hourly based workers' compensation to each billing item.

|

•

|

For PEO templates, select Limit to indicate that each bill item must stop at the prescribed high limit for billing purposes. For bundled amounts, the bundled rates are decreased. On bundled companies, the rate decreases when the limit is met for items that are limited. It decreases by the amount of the client’s bill rate for the item. |

|

•

|

For PEO templates, select Discount Shelter to indicate that clients with this template should receive a benefit of any sheltered amounts (Section 125, 401(k), and so on) for each bill item. |

|

•

|

Workers Comp High Comp indicates whether compensation is limited on employees determined as highly compensated, or whether to compute it on all compensation-eligible wages. An employee is high comp if they are over the high compensation limit (either the state-mandated or officer). |

|

•

|

Workers Comp Overtime indicates whether the Workers’ Compensation should use two-thirds (2/3) of overtime for premium computations. |

Note: Use the Special FUTA Rate only as an override; do not use it for all clients. If the federal government changed FUTA to be 0.85% and you used this field to set the FUTA rate for each client, you would have to change it for every client.

|

12.

|

If appropriate, enter the Special FUTA Rate as a percentage. |

|

13.

|

Select Skip Employee Fees for New Clients if you will not charge the client for new hires and terminated employees during the first 30 days of service. |

|

14.

|

Complete the additional sections below, as needed. When finished, click Save. |

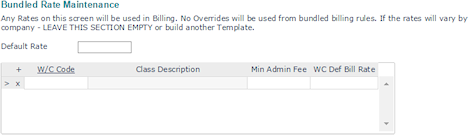

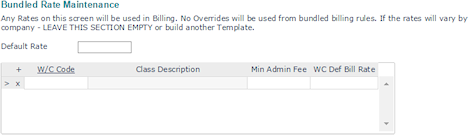

Maintaining Bill Rates and Administration Fees

If this is a bundled billing template that uses default rates, use the Bundled Rate Maintenance panel to maintain the bill rates and administrative fees.

Note: If the Default Rate is greater than zero, the system uses it for any Workers' Compensation code not listed in the table. If there is a value in this field and no value in the W/C Code field, there may be billing errors; use the Default Rate with care. If you leave the Default Rate blank, users entering data for clients with this billing template see messages that the listed Workers' Compensation code does not have a billing amount. The system continues to display this message until you update the bill template for the code or enter a default amount.

|

Field Name

|

Description

|

|

Default Rate

|

Enter the Default Rate to use for all clients' Workers' Compensation rates not defined in the table. This value is useful for "one-price-fits-all" clients.

|

|

W/C Code Grid

|

For each Workers' Compensation code that requires a different rate:

|

•

|

Enter the W/C Code. The Class Description displays. |

|

•

|

Enter the Min Admin Fee amount to use. This overrides any amount entered on the client record, except for special rates. The system discounts the minimum fee by the special discount rate. |

|

•

|

Enter the WC Def Bill Rate, which is the default billing rate for the W/C Code. |

|

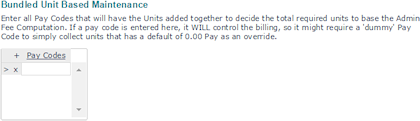

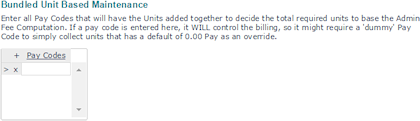

Selecting Pay Codes That Control Unit-based Administration Fees

If this is a bundled billing template with rates based on units, use the Bundled Unit Based Maintenance panel to select the pay codes that control the unit-based Admin fee.

Enter all Pay Codes to include in the Admin fee computation.

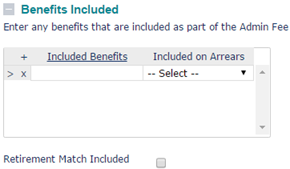

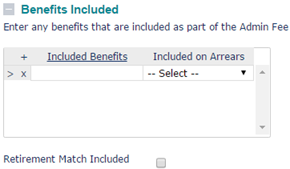

Defining Benefits Included in Administration Fees

Use the Benefits Included panel to define the benefits included in the Admin fee.

For each benefit:

|

1.

|

Enter any Included Benefits for this billing template's Admin fees. |

|

2.

|

Indicate whether the benefit plan is Included on Arrears: |

|

•

|

Yes: The system charges the fee even if employees do not receive pay. The system creates a zero billing, charging the value of the benefits against the Admin fee, and resulting in negative Admin fees. |

|

•

|

No: The client pays the benefit for employees when they do not receive pay. The system bills clients for each employee (who is not on leave) receiving an arrearage voucher. It returns the value of these charges upon the employee's return, with the assumption that billing covers all fees up to that time. If the employee never receives another payment, the system continues the charge. |

|

3.

|

Select Retirement Match Included to include the match amounts in the billing template amount. |

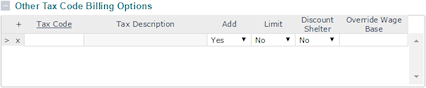

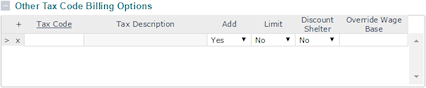

Including Other Taxes

Use the Other Tax Code Billing Options panel to include other taxes in the billing template.

To include other taxes:

|

1.

|

Enter each Tax Code to include. |

|

2.

|

Indicate whether to Add the tax code to the Comp rates. |

|

•

|

Yes: The system adds the tax code to the Comp rates listed above. Typically, you select Yes for unbundled billing rates. |

|

•

|

No: Select No if the tax code is included in the Comp Rate above. Typically, you select this for bundled amounts. |

Note: On bundled billing, the rate decreases when the limit is met for items that are limited. It decreases by the amount of the client’s bill rate of the item.

|

3.

|

Indicate whether to stop at high Limit if this tax code stops at prescribed limits. |

Note: You cannot set the Limit or Discount Shelter for an ASO billing Template Type to Yes. (An error message displays when you click Save.)

|

4.

|

Indicate whether the billing template includes Discount Shelter limits. |

|

5.

|

Enter the Override Wage Base if there is a wage base override for this tax code. Leave this field blank if the standard wage base applies. |

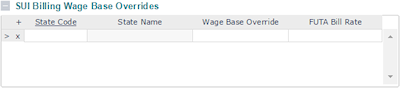

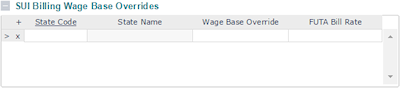

Entering Overrides by State

Use the SUI Billing Wage Base Overrides panel to enter overrides by state.

To enter overrides by state:

|

1.

|

Enter each State Code. The State Name populates. |

|

2.

|

Enter the taxable Wage Base Override the system should use for SUTA billing calculations for the state. |

|

3.

|

Enter the overriding FUTA Bill Rate for the state. This overrides the Special FUTA Rate, if any. |

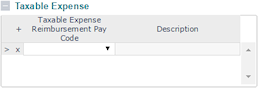

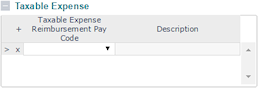

Classifying Expense Reimbursement Pay Codes

Use the Taxable Expense panel to classify any expense reimbursement pay codes as taxable pay codes for the purposes of tax billing.

Select each Taxable Expense Reimbursement Pay Code. The Description populates.