Establishing State Tax Rates (SUTA)

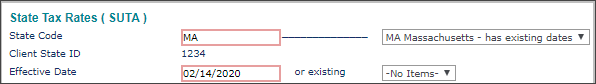

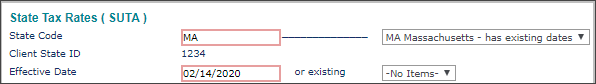

Set a client’s state SUTA information (instead of using the PEO’s state SUTA rate) with the State Tax Rates (SUTA) form.

To establish SUTA rates:

From Client|Change, select State Tax Rates (SUTA).

Fill in the required fields.

|

Field

|

Description

|

|

State Code

|

Enter a two-character state code, or select it from the drop-down. The Client State ID displays.

|

|

Effective Date

|

Enter a date when the bill rate goes into effect, or select an existing date to edit.

|

Note the following:

|

•

|

SUTA is based on an employee's home location and is specified by the location code in the Employee Master/Details. Entering hours for a different state does not trigger the SUTA for that state. |

|

•

|

You cannot have multiple SUTA states in a single payroll. If an employee worked in multiple states for a single payroll and you need to calculate SUTA for each state, you must run a separate payroll to process hours for each state the employee worked in. For each of these payrolls, you must change the employee's home location in Master/Details before processing. |

Establishing Officer and State Bill Rates

Establish officer and state bill rates with the Rate Breakdown panel.

To set these rates:

|

2.

|

From Client|Change, select State Tax Rates (SUTA) to view the Rate Breakdown panel. |

form.png)

|

3.

|

Fill in the required fields.

|

| Field |

Description |

| SUTA Rate |

Enter the client's SUTA Rate for this state. |

| Officer SUTA Rate |

Enter the Officer SUTA Rate if it differs from the regular SUTA rate. |

| SDI Rate |

Enter an employer's SDI Rate if the employer pays disability insurance in this state. |

| Miscellaneous override rates |

Enter the miscellaneous override rates for employer-paid taxes. If these fields are left blank, the system uses the default rate.

|

•

|

Enter the State Misc1 Rate (Tax ID 26). |

|

•

|

Enter the State Misc2 Rate only to set employer tax rates for Vermont Childcare Employee Tax Rate (Tax Code 48-28). If no tax rate is entered for the employer, but a tax rate is entered for the employee using the State Misc 2 Employee Rate field below, you will see the full amount for the employer calculated at 0.44%. The employee tax rate below does not offset the employer tax rate here. So, you must enter the tax rates for both the employer and the employee in this form if using overrides. |

|

•

|

Enter the State Misc3 Rate field to set employer tax rates for paid family medical leave for tax codes: |

For example, you can increase the tax rate paid by the employer.

|

| Wage Base Override |

Enter the Wage Base Override to use a different amount than what is specified in the Vertex guide. For example, Michigan has two tiers based on experience. |

|

State Misc 2 Employee Rate

|

Enter the State Misc 2 Employee Rate only to set employee tax rates for Vermont Childcare Employee Tax Rate (Tax Code 48-27). The employer tax rate above does not offset the employee tax rate here. So, you must enter the tax rates for both the employer and the employee in this form if using overrides.

|

|

State Misc 3 Employee Rate

|

Enter the State Misc 3 Employee Rate to set employee tax rates for paid family medical leave for tax codes:

For example, you can decrease the tax rate paid by employees.

|

|

Note: If you adjust State Misc2 Rate or State Misc 2 Employee Rate and State Misc3 Rate or State Misc 3 Employee Rate, you must use both the corresponding fields. Do not assume one field will adjust automatically when a change is made to the other field.

|

Importing SUTA Rates Data

You can access the State Tax Rates (SUTA) import template in the Data Import Tool from this form to import SUTA rates data by clicking Import .

.

The State Tax Rates (SUTA) import template option and its tabs/fields automatically display when you access this template directly from the State Tax Rates (SUTA) form.

Note: You can also navigate directly to the Data Import Tool by clicking  (Back Office), then select Data Import Tool on the Operations|Import Processing menu. In the Data Import Tool form, select the State Tax Rates (SUTA) import template option.

(Back Office), then select Data Import Tool on the Operations|Import Processing menu. In the Data Import Tool form, select the State Tax Rates (SUTA) import template option.

Note the following when importing State Tax Rates (SUTA) data:

|

•

|

Importing only creates/adds new entries and does not edit or update existing state tax rate entries. |

|

•

|

If you try to import a record with the same state code and effective date combination as an existing record the following message displays, "A record already exists for Client <Client ID> for <state code> with an effective date of <effective date>. Updates to existing records should be done on the State Tax Rates (SUTA) form." |

|

•

|

You can import at the operations level for single clients or for multiple clients at once. |

|

•

|

If you select a state code based on settings on the State Rules form and on the Tax tab on the Client Details form a warning displays on the Messages tab in this import template before you select Import, which prevents you from adding an unnecessary record if the state is not set up as a client reporting state. |

For example:

|

•

|

If the SUTA PEO/Client Based field is set to SUTA is PEO Based on the State Rules form the following message displays, "Warning: <state code> is not a client reporting state. There should not be a client reporting entry required for Client <Client ID>. Row <row number>." |

|

•

|

If there is no state code set on the Tax tab in the State Tax Setup panel on the Client Details form the following message displays, "Warning: The State Information for <Client ID>/<State Code> is not on Client Details State Tax Setup section. Row <row number>." |

|

•

|

If the SUTA PEO/Client Based field is set to SUTA is PEO Based on the State Rules form AND you select the Officer SUTA Client Based field the following message displays, "Warning: Client Reporting is required for Officers only in <state code> for Client <Client ID>. Row <row number>." |

Note: These warnings are informational only and when you select Import, the system imports the data unless there are other failure messages. In addition, the warning messages display in the Confirmation Report after the import finishes with the "Success" import status.

|

•

|

Two failure errors occur in conjunction with the Wage Base Override column: |

|

•

|

If the amount is less than zero (0) the following error displays, "You can't set an override wage base less than zero - Client <Client ID> Row <row number>." |

|

•

|

If the amount is equal to zero (0) the following error displays, "You can't set an override wage base of zero - Client <Client ID> Row <row number>." |

|

•

|

Users whose user role is set to DENY for the State Tax Rates (SUTA) form cannot import data using the State Tax Rates (SUTA) import template and subsequently, the Data Import Tool icon will not display on this form. |

|

•

|

Users whose user role is set to FULL or INQUIRY for the State Tax Rates (SUTA) form, but whose user role is also set to DENY for the Data Import Tool cannot view the Import icon on the State Tax Rates (SUTA) form. |

|

•

|

Users whose user role is set to INQUIRY for the State Tax Rates (SUTA) form can view the State Tax Rates (SUTA) import template, but cannot import data. |

|

•

|

Users whose user role is set to INQUIRY for the Data Import Tool can view the form and import template options, but cannot import data. |

|

•

|

Users who do not have access to a particular company through client access groups are unable to import data into that company. |

form.png)

.

.![]() (Back Office), then select Data Import Tool on the Operations|Import Processing menu. In the Data Import Tool form, select the State Tax Rates (SUTA) import template option.

(Back Office), then select Data Import Tool on the Operations|Import Processing menu. In the Data Import Tool form, select the State Tax Rates (SUTA) import template option.