Defining Hours Worked (by Months) Calculation Basis for PTO Benefit Plans

Define Hours Worked (by Months) as the Calculation Basis for PTO benefit plans with the Pay Codes for Hourly Accrual and Hours Worked panels.

To define hours worked (by months):

| 1. | Click the Client menu. |

| 2. | From Client|Change, select PTO Benefit Plans. |

| 3. | Set Calculation Basis to Hours Worked (by Months) to view the Pay Codes for Hourly Accrual, Hours Worked, and Pay Period Accrual Threshold panels. |

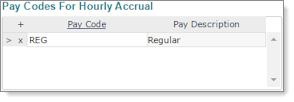

| 4. | In the Pay Codes for Hourly Accrual panel, enter each Pay Code on which to base the accrual, such as regular pay. The Pay Description for the code displays. You must specify at least one pay code, or no paid time off accrues because the system cannot complete the calculations. |

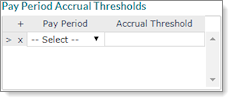

| 5. | From Pay Period Accrual Thresholds, select a Pay Period (weekly, bi-weekly, semi-monthly, monthly). |

| 6. | Set an Accrual Threshold to limit the number of hours that employees can accrue for a specific pay period. If there is no limit on PTO accruals, leave this table blank. |

| 7. | Fill in the remaining Hours Worked fields as required. |

|

Field |

Description |

|

Seniority Level |

For each seniority level:

|

|

Hours Type |

Select either Worked or Paid. If no value is set, the system assumes hours worked. |

|

Apply Current Hours Taken before applying Stop-Balance limits |

Select to subtract the hours used before applying a stop-balance limit. If you do not select this option, the system disregards the hours already used. |

|

Enforce Yearly Maximum By Pay Period |

Select to enforce the yearly maximum for this type of accrual on a pay period basis (yearly max divided by pay periods per year). If you do not select this option, the system ignores the yearly maximum, but not at the pay period level. |

| 8. | Click Save. |